Tax Services

Minimize Your Taxes

It’s not what you earn, it’s what you keep. Taxes are an unrecoverable cost but professional guidance into tax management can save the average investor thousands of dollars each year.

Our strong foundation in tax planning and preparation uniquely qualifies us to navigate the harsh tax terrain so you don’t have to.

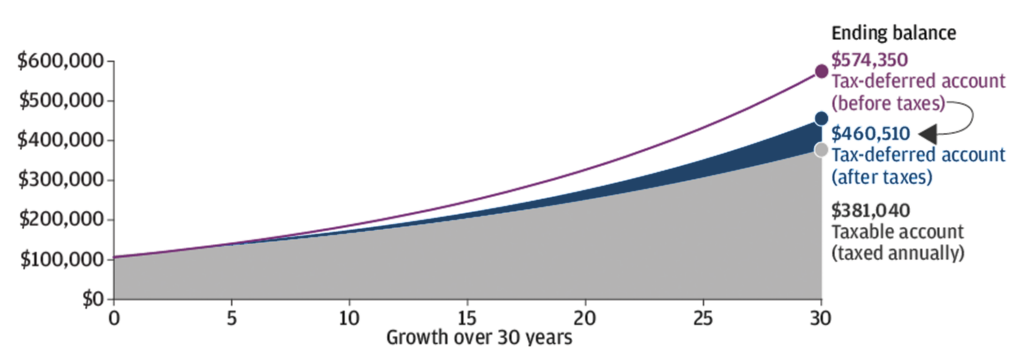

The Value of Tax Deferral Strategies

HYPOTHETICAL ASSUMPTIONS

1. $100,000 initial investment

2. 24% tax rate

3. 6% compounded annual rate of return

Source: J.P. Morgan Asset Management. Chart shows aftertax $100,000 initial account value in the beginning of year one for a tax-deferred account and a taxable account. Assumes a 6.0% annual return for both accounts. Investment returns in taxable account are taxed annually at 24% (capital gains and qualified dividends are not considered in this analysis). Tax-deferred account balance is taken as a lump sum after year 30 and taxed at 24% federal tax rate. This hypothetical illustration is not indicative of any specific investment and does not reflect the impact of fees or expenses. This chart is for illustrative purposes only. Past performance is no guarantee of future results.

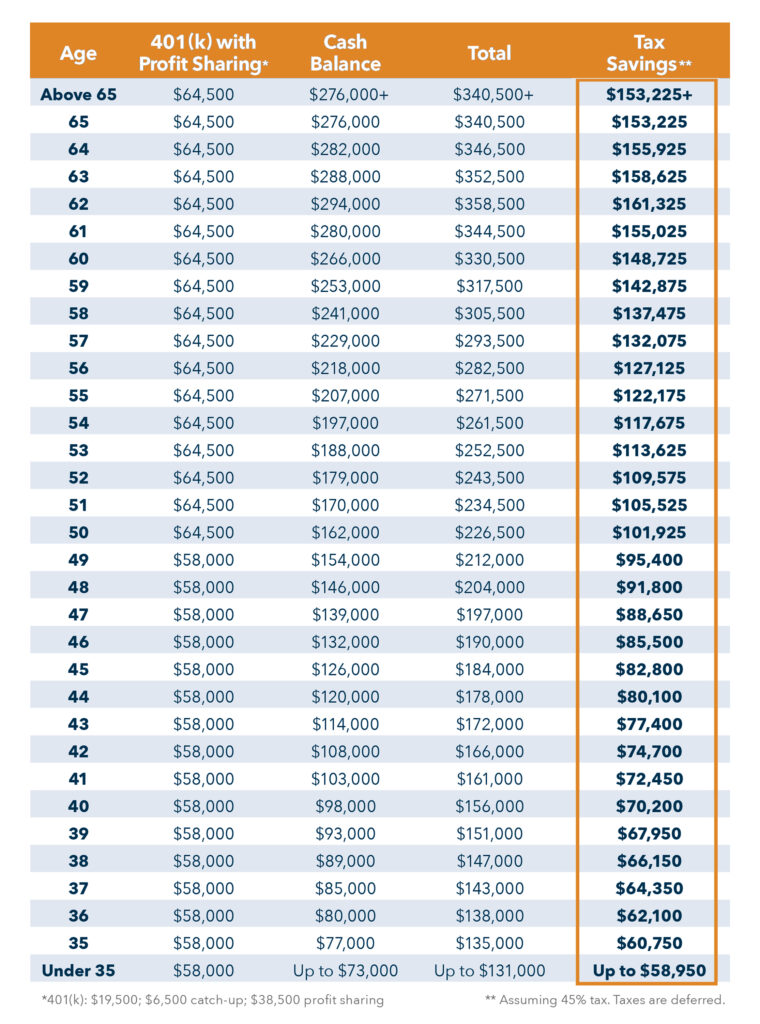

The Power of Combining Retirement Plans

*Maximum 401(k) with Profit Sharing amounts may be reduced if compensation is lower than the IRS maximum compensation limit of $290,000 and other deduction limits may apply.

*Maximum cash balance amounts assume a 3-year average compensation of at least $230,000. Lower 3-year average compensation may reduce the amounts shown.

After We Meet, You'll Be Able Too

Determine the priority of retirement funding strategies to determine when and were dollars should be invested for tax purposes.

Helping highly compensated individuals dramatically reduce taxable income while saving for retirement.

Helping charitably inclined investors donate appreciated investments to avoid capital gains tax while preserving their charitable donation deduction.